Automated trading systems based on quantitative methods for data analysis have become a dominant part of the daily turnover in the financial markets in all asset classes.

The real cause of doubt in technical analysis methods is that not a lot of people are able to create and implement such reliable and robust strategies.īut there is much more to technical analysis than that which is “visible on the surface”. This shouldn’t be taken as an assumption that all automated trading systems are successful, there is plenty of evidence against that, but rather that success depends on following a sound strategy, whether discretionary or systematic. There are plenty of famous hedge funds with proven successful track records spanning for more than 20 or 30 years that have achieved their success by using systematized and automated trading systems. Their main argument is the existence of successful algorithmic trading strategies. On the contrary, the supporters of technical analysis and quantitative research, insist that if the random walk theory is correct, it means that many well-defined and proven trading methods based on mathematics and pattern recognition should fail. As prices move only in response to the latest available information or news release and it is impossible to predict their move only by looking at a chart. Many analysts support the thesis that prices are formed by the balance of supply and demand and are driven only by fundamental and economic data. A lot of academic research suggests that price movements are close to a random walk. There has always been an opposing camp of people who are skeptical about the predictive power of the technical analysis. Even those traders who do not rely on technical indicators in their trading strategies, tend to keep them on their charts and watch them along during the day. This publicity relies on simplicity and shows the widespread acceptance of technical analysis. Even indicators considered quite exotic not so long ago, such as the Fibonacci retracement levels, find their place in popular daily newsletters and analyses. For example, the 200-day moving average has become the benchmark for the stock market indices trend direction. Everyone is constantly bombarded by news and headlines talking about price trends, double tops, and bottoms, low volume, high volume, consolidation, stagnation, etc. There are some aspects of technical analysis that have become so mainstream that the financial media is using them to provide simple explanations to every major event on the markets.

In addition, the quantitative approach allows you to backtest different trading systems and estimate their expected risk and reward parameters.

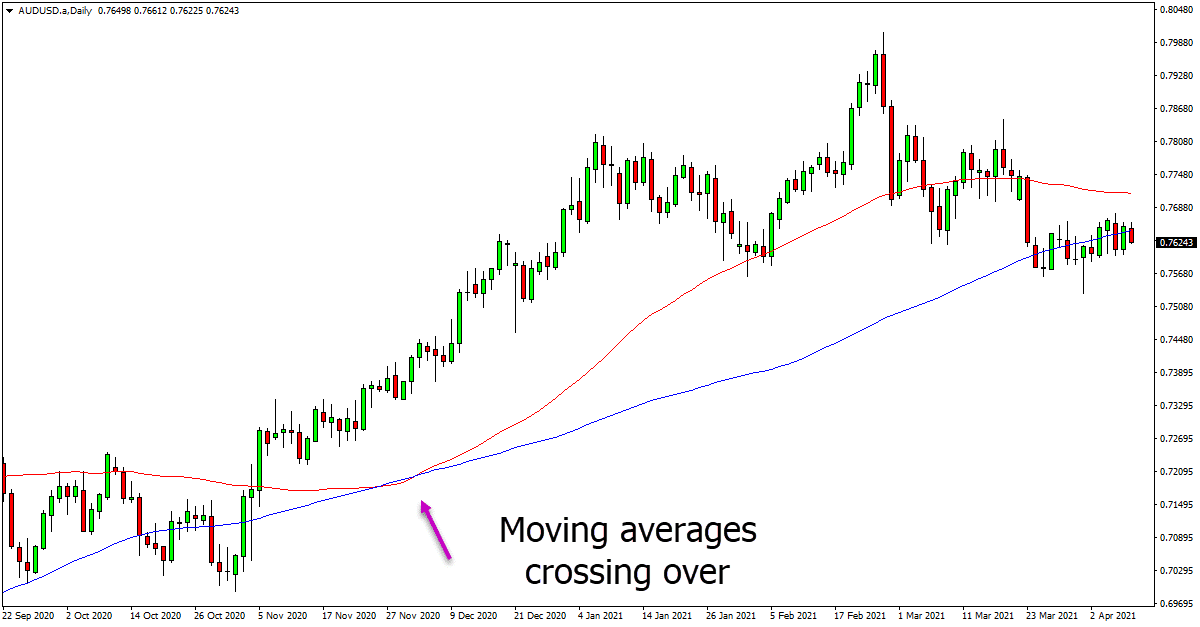

The financial markets are a complex system so there is more than one way to achieve a given result. Nowadays a trading strategy can rely on from a simple combination of indicators to an advanced neural network to forecast price moves. Multiple technical indicators, intra-market analysis, machine learning, and artificial intelligence are just a few examples of the tools and methods in their arsenal. Today everyone interested in technical analysis has a huge variety of powerful tools to their disposal. While it is considered by many a simplified approach to trading on the financial markets, based on identifying trends and looking for patterns on charts, it has evolved to something much more than that.īack in the days technical analysts relied on simple things such as drawing trendlines or following a simple Moving Average crossover strategy. Technical analysis is one of the most popular techniques, used in trading systems design.

0 kommentar(er)

0 kommentar(er)